Legacy research

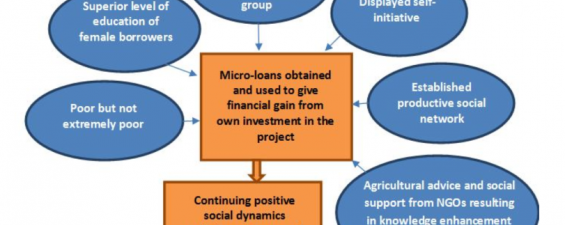

This follow-on SRA explored this issue in depth, including what types of credit services are most effective. Also how they positively affect farm income and social outcomes, such as empowerment of women in rural communities. It identified several opportunities that can be pursued to further develop microfinance as a lever for value creating in the Pakistan agricultural sector. There is strong demand to do so from the Pakistan government and other stakeholders, especially in the finance sector.

Traditional “informal” credit channels are still important, such as obtaining inputs from the arthi (agent) on credit to be repaid at harvest. Nowadays, commercial and NGO microfinance schemes are also used by farmers, again mainly for operational purposes to smooth out their cash flows throughout the year. This is of concern because capital investments, such as equipment and farm enterprises, are likely to have greater effects on productivity improvement over time.

Recommendations included

- Microfinance is playing a significant role in the development of smallholder farms but farmers need better awareness to make decisions.

- General improvement in financial literacy will raise borrowing rates. Mobile phones and radio could be used to promote learning.

- Islamic finance can play a greater role in the business of farming. There is an unmet demand and policies should be introduced to promote Islamic financial services.

- Farmers are not very aware of government schemes and only some lenders appear to be promoting the financial assistance schemes. Promotion to raise awareness and cooperation with lenders is needed.